STORIES

Now that it's bid farewell to its Silicon Valley birthplace, KAV Helmets continues consolidating and preparing for growth in its Buffalo operations. KAV, which uses 3D printing technology to create custom aerodynamic helmets designed to reduce brain injuries, is in the process of consolidating its manufacturing operations into the Barcalo building on Louisiana Street. CEO Whitman Kwok touted KAV’s production process as a “one-of-a-kind advanced manufacturing platform in the heart of Buffalo.” The key to KAV's mini-fab manufacturing process, he said, is the ability to produce a large amount of product with a small number of inputs. While KAV plans to stay in the protective gear space, Kwok said products beyond helmets are expected to be released by January. The local facility became operational in May. It has gone so smoothly that Kwok determined continuing to run a duplicate plant in Redwood City, California, no longer made sense. “This facility has done so well that we are actually not only building this factory here, but also consolidating production capabilities,” Kwok said, noting that the company saw double-digit month-over-month revenue growth when the facility came online. The consolidation, Kwok said, was also driven by Buffalo’s talent pool and vibrant cycling community. Equipment started being shipped from California to Buffalo in August, and those employed at the Silicon Valley location have been offered jobs in Buffalo. If those employees opt against moving, Kwok said, they can still work remotely. An uptick in sales since May will also allow KAV to continue investing in facilities and people. He said the company recently hired two employees on the production side and more are likely to come. KAV employs between 10 to 20 people. Kwok declined to provide an exact total, citing “competitive reasons.” “We will continue to hire, but I don’t want to get too far ahead of ourselves. Obviously, it depends on revenue. We have a bunch of new products that are coming out, which will drive additional growth,” he said.

OCTOBER 08, 2025

"How Connected Data Can Empower Care Teams"

The story of wellconnected's use of trusted, connected data powering whole-person care across communities resonated at one of the nation's leading conferences on broadening social care. CEO Duane Conners joined with leaders from 4medica and the New Jersey Innovation Institute to deliver that message, and insights into their successful partnership, at the Civitas 2025 Annual Conference in Anaheim (September 28-30.) Conners showed how wellconencted's allco platform builds transformative processes in Chicago and Cook County, Illinois, as well as other communities in New York, New Jersey and West Virginia, through leveraged data to systemize and track social care. Allco's coordinated system improves processes and transparency and creates improved care for a community's most vulnerable. "At wellconnected, we believe true interoperability must go beyond clinical data to include behavioral and social insights that shape health every day," said Conners, wellconnected founder. “By partnering with 4medica and NJII, we're showing how connected data can empower care teams, strengthen communities, and deliver on the promise of whole-person care.” Conners and wellconnected, and their partners, hosted a featured session at the conference: Transforming Whole-Person Care: Unlocking the Power of Cross-Sector Data Sharing. He was joined by 4medica President Gregg Church, Rashidat Balogun, MPH, Managing Director of Chicago Regionwide CIE, Illinois Public Health Institute and Jennifer D'Angelo, COO and EVP, Healthcare Division of the New Jersey Innovation Institute.

OCTOBER 07, 2025

AI and Computer Vision Combine For New Hello Package Advantage

Hello Package's new package solution system includes a dynamic new release of tech built to make this startup take a new step forward. CEO Paul Favorov introduced how Hello Package will combine computer vision and AI to calculate package volume. Favorob said the enhanced system will boost tracking and security for residents of the properties benefitting from Hello Package. Drivers will also benefit from the computer vision and AI process. Hello Package, through its parent company, Package Solutions, is a portfolio company of Brown and WHite Ventures.

OCTOBER 06, 2025

KAV Moves Forward In Buffalo's First Ward

Pallets of printers and testing gear that arrived from KAV's Redwood City, California plant have been reestablished in the revolutionary cycling helmet-maker's Western New York factory this week. Printers; some new, others boxed up and repurposed from KAV's Silicon Valley Operations, are rolling onto the floor and running already. A nook in the company's factory, easily mistaken for a storage space, is being designed to become the factory's new testing zone for models of helmets already being produced and others yet to hit the market. It's part of KAV's migration East, a decision made this summer to amplify production and efficiency. Some KAV staff members are on the way to Buffalo. At least one engineer's arrived to support operations. Others are still measuring the opportunity. Cost-savings come with the decision by KAV CEO Whitman Kwok to head east. Production has already accelerated. KAV Operations Director Alex Grenning says the Buffalo plant hit a new stage of production this month.

SEPTEMBER 16, 2025

Leading through his passion for new business and finance, Ian Palmer cuts an impressive path through the business school at Baldwin Wallace University. Brown and White Ventures's Fall 2025 intern is not only a double major in Finance and Accounting, but also minors in Mathematics. The junior from Berea, Ohio already leads the university's investment club. There, Ian oversees a student group that also focuses on executive restructuring and member development through structured pitch processes. Ian is also co-founder of an equity research firm for retail investors. It provides accessible market insights and investment recommendations. Ian has hands-on financial experience competing in the ACG Cup, an M&A case competition, as well as the CFA Institute Research Challenge, where he applied valuation techniques, pitch development and strategic analysis in real-world settings.

SEPTEMBER 12, 2025

Brown and White Ventures' newest intern will wrap up her bachelor's degree by age 19. Skye Sharpe chose to study Economics at the University of South Florida because she's academically drawn to analytics and mathematics and she knew it would challenge her. "I love learning new things and challenging myself," said Skye, a Tampa, Florida resident. "I expect a lot from myself and recognize that my growth and success is dependent upon my knowledge." Skye says travels to Switzerland and the Czech Republic shaped her understanding of how other's lives are different from hers. Trips with her husband to Guatemala and Puerto Rico reinforced how broad a spectrum there is in cultures and customs. It's inspired her to pursue backpacking around the world in her future. And she's excited to become a mother. She and her husband are expecting a daughter. She says her faith has shaped her in every decision she's made. "Having a family so young definitely brings out even more ambition in me than I ever thought I’d have, which is saying a lot." Skye will intern in the sixth semester of Brown and White Ventures internship program. Launched in the Spring of 2024, twelve students have now participated in the fund's educational opportunity.

SEPTEMBER 10, 2025

Solving boring problems with innovative solutions. Neil Bommele described that as being at the heart of healthy startup companies; the kind that, when woven with high-value founders and well-measured business planning, can attract startup investment from Brown and White Ventures and other venture capital funds. Bommele, a 1987 alumnus of St. Bonaventure University, and an associate and advisory board member of Brown and White Ventures, returned to his alma mater with fund co-founder Jim Aroune (SBU '87) to share the story of the fund to students beginning their study of venture capital and other matters of entrepreneurship. Professors Todd Palmer and Tom Cullen, co-leaders of the weekly course on entrepreneurship, launched their Fall 2025 semester presentation of the class September 2nd with a Q&A session with Bommele and Aroune. Both shared the story of the fund's founding by Charles O'Neill (SBU '83) and the development of Brown and White Ventures' investment portfolio in 2025. Brown and White Ventures has welcomed ten St. Bonaventure students and alumni into its internship program through the fund's first 20 months of operation.

September 3, 2025

Breaking Into VC: Built With People, Not PedigreeBona's Alum, Fund Advisory Board Member, Shares His Journey

By Denzel Gregg

When I first stepped into venture capital, I didn’t know what to expect. I didn’t come from Wall Street, consulting, or a startup. My background was all over the place: professional athlete, a stint in politics, back into college athletics, and then law school. The closest thing I had to VC on my resume was a finance degree I earned nearly ten years ago and never really used. So, I walked in with no experience, just curiosity and the willingness to learn. Eighteen months later, I’ve realized that venture capital isn’t just about numbers, valuations, or exit multiples. At its core, it’s about people. And that’s something anyone, from any background, can learn if they’re willing to. The Paperwork Only Gets You So Far One of my earliest experiences as an intern in VC was dealing with the fund paperwork—LPAs, subscription agreements, governance language. To be honest, it was overwhelming at first. I was still a law student learning how to parse dense documents, and suddenly I was looking at contracts that determined how millions of dollars would be governed. But the deeper I got into it, the more I realized the real lesson wasn’t in the fine print. The paperwork creates the framework, but it doesn’t create trust. A Limited Partner doesn’t invest because the clauses are airtight. They invest because they believe the people running the fund will honor those words. That process felt familiar. In law school, you quickly learn that it’s not enough to recite rules; you also have to apply them in a way that gives people confidence. A client doesn’t hire you just because you know the statute. They hire you because they believe you’ll use that knowledge to protect their interests. The same is true with LPs. They’re not investing in the document. They’re investing in the people behind it. What I found is that the paperwork process is actually a relationship test. It forces you to explain things clearly, to be transparent about risks, and to show humility when you don’t have every answer. If you handle that process with openness, the documents become a safety net. If you handle it with arrogance, the documents become walls. One of my earliest lessons in VC was simple: the documents set the rules, but the relationships set the tone. The trust you build in those conversations lasts longer than any signature. Founders Are Betting on You Too I used to assume the dynamic in VC was one-sided. Investors had the money, founders needed it. But after sitting with dozens of founders, I realized it’s more mutual than I ever imagined. When a founder takes your capital, they’re not just accepting a check. They’re making a bet on you. They’re asking themselves hard questions: Will this investor stick around when things get messy? Will they make introductions that actually move the needle? Will they believe in me when the numbers don’t tell the whole story? Some of my most meaningful experiences in venture haven’t involved spreadsheets or valuations at all. They’ve been the moments when a founder called after running dry on capital and we worked together to develop strategy and a path forward. Or when we connected them to someone in our network who helped accelerate their sales process by months. Or when we simply listened, no agenda, because sometimes that’s what a founder actually needs. It reminded me of my time as an athlete. A great coach isn’t measured only by how they celebrate wins, but by how they respond to losses—what they say in the locker room when the scoreboard looks bad, how they instill belief when momentum feels gone. Founders, like athletes, need people in their corner who believe in them not just when they’re winning, but when they’re fighting uphill. Writing a check is the easy part. What founders really remember is how you showed up when there wasn’t a clear win on the table. Money is transactional. Belief and support are relational. And in the long run, founders gravitate toward investors who invest in both. Markets Move, People Endure Markets are fascinating to study. I’ve spent hours digging into sectors like broker connectivity and fintech infrastructure, trying to understand what felt like the most nuanced product-market fit. But the longer I’ve been in VC, the clearer it’s become that markets are fluid. They expand, contract, pivot, and sometimes vanish altogether. What doesn’t change is how people respond when the market turns. Some founders freeze when conditions shift. Others adapt and use the turbulence as fuel. The best don’t just ride the wave. They build boats sturdy enough to weather storms. I saw this firsthand working in municipal government through COVID. Overnight, the playbook went out the window. Budgets collapsed, businesses shut down, and citizens looked to leadership for stability. In those moments, it wasn’t about having the perfect policy on paper. It was about staying composed, communicating clearly, and finding solutions when none seemed obvious. Some leaders froze; others adapted. The ones who led effectively weren’t necessarily the most experienced, but the ones who had the grit to keep moving when the pressure mounted. Venture works the same way. The founders worth betting on aren’t always in the hottest market. They’re the ones who steady the ship when the water gets rough, who don’t panic when deals stall, and who find another way forward when the first plan fails. You can learn market dynamics from a book. You can model growth curves in a spreadsheet. But character under pressure? That’s something you only see in people. And in venture, that’s where the real bet is. Learning Is the Real Job Coming into VC, I didn’t have the traditional toolkit. I wasn’t a banker or consultant with years of deal experience. I had to build it on the fly, asking what felt like “basic” questions, poring over financials, and learning how to spot red flags in governance documents. What surprised me most was how open people were if I just admitted I didn’t know something. Instead of pretending, I asked. Instead of assuming, I listened. Over time, the questions got sharper, the instincts more reliable, and the confidence more natural. What I thought was a weakness—starting from scratch—actually turned into a strength, because it forced me to approach everything with humility and curiosity. It reminded me of law school. On day one, no one really knows how to read a case or think like a lawyer. You stumble through, you get cold-called, you second-guess yourself. But slowly, the repetition builds discipline. You learn to ask better questions, to analyze differently, and to see patterns where you once saw noise. Venture has been no different, just with higher stakes and a different set of textbooks. The real job in VC isn’t about already having all the answers. It’s about building the discipline to keep learning. Markets change. Deal structures evolve. Technologies shift. If you think you’ve “arrived,” you’re already behind. And this lesson applies far beyond venture. You can break into any field, whether it’s law, politics, or venture, if you stay curious, humble, and willing to learn. The technical knowledge will come. The mindset has to be there first. The Human Side of Venture Eighteen months into venture capital, the biggest lesson I’ve learned is that this work is far less about money than it is about people. Paperwork matters, but trust matters more. Markets shift, but character endures. Founders need more than capital—they need belief. And no matter where you start, the real job is to keep learning. I came into this field with no traditional background. Athlete, politics, law student—nothing on my résumé said “venture capitalist.” But that turned out not to be a weakness. If anything, it made me approach the industry with fresh eyes and open ears. I’ve learned that you can break into any field if you’re willing to do the work, stay humble, and connect with people in a real way. The technical side of venture—valuations, diligence, structures—can be taught. What makes the difference is showing up as someone others want to work with. Because in the end, the cap table tells you who owns what, but it doesn’t tell you who showed up when it mattered. And that’s the part people never forget.

AUGUST 19, 2025

In a time when one in four Americans have been victimized by package theft on their property, 2025 seemed right for an answer to what's become a $12 billion annual crime impacting 58 million people in the U.S. Enter Hello Package and its tech-driven, customer-focused response. Hello Package's smart package solution, rolling out into housing developments, creates on-site, open-shelving access in multi-family and student housing communities. Creators of PackageSolutions' lead service say HelloPackage has four times the capacity of normal package locker solutions. Its commitment to innovation and tech advancement provides human assistance and automatic adaptation to the growing e-commerce industry and large-scale increase in package volume. HelloPackage leaders call it a future-proof product. HelloPackage creates adaptive spaces in existing housing structures and also offers a solution that includes an independent package pod, where both delivery staff and residents have digitally provided access. See how the system works in the company's short demonstration video: https://www.youtube.com/watch?v=IWKW9Q71LdI Brown and White Ventures announced August 1, 2025 its investment commitment to PackageSolutions and HelloPackage.

AUGUST 4, 2025

You Gotta Believe.. In Data

How wellconnected Brings Social Service Together

Belief in data. Brown and White Ventures' new portfolio company, wellconnected, is driving that expression to draw funders and nonprofits together to better serve the people who need their services. CEO Duane Conners said wellconnected's platform, allco, has been engineered to fit an agencies’ specific needs around intake and case management. The platform coordinates that information in such a way that users can pull automated health information summaries, which are presented in layman terms and create crucial context for SDOH. “Just like an HIE, ‘allco’ has a longitudinal record for social care,” Conners said. “The difference is ours is directly built into the case management suite. So if someone walks into a shelter, it’s a full-stack understanding of their history – if they ever needed transportation or childcare or have food insecurity – because all of those community agencies really need to work together.” Conners spreads that message at events like the HIMSS conference in Las Vegas, an international gathering of those leading cutting-edge healthcare and IT earlier this year. There, he shared the story of wellconnected's first-of-its-kind community information exchange in Chicago, Buffalo, New Jersey and West Virginia and the importance of leveraging data for the social determinants of health. “If someone comes in for housing assistance, our users can see historically that he lost his job and he needed rent assistance that had fallen off," Conners said. "So he can step in and start working with those other providers to make sure that doesn’t happen again.” The company was formed in 2021 as a mission-driven startup aiming to create a better social safety net for the people in our society who need help. Through its ‘allco’ software, the company brings a networked enterprise platform to a fractious and inefficient industry, driving collaboration between nonprofits and their funders. Government entities and foundations in the states and communities wellconnected serves are driving adoption to thousands of nonprofits. Learn more at: https://www.youtube.com/watch?v=NmhOsyH2Q3Q

JULY 30, 2025

Steve Steinberger collected New York Knicks trading cards as a kid. Walt Frazier was his guy, but Steinberger's entire collection of Knicks cards remained his treasured childhood possession. Fifty years later, Steinberger's committed his energy as an entrepreneur to the future of digital collectibles, including blockchain trading cards that make the ones he used snap up as a kid seem like archaeological artifacts. "They always got beat up. They always lost value because of their physical condition," Steinberger said. "With the ones we help people create, they don't have to worry about that. Plus, the ones created can be verified as original works, with authentic value," said Steinberger, the founder of NFT-tradingcards.biz. With a platform that helps anyone create NFT trading cards on the block chain, Steinberger is helping to cut the path for not only artists, professionals, creators and influencers to profit from their own talent, brands and reputation, but, of course, athletes can do the same. Steinberger built the company as NIL changed the landscape for athletes of all ages, all sports, all levels of competition. Steinberger, a Canandaigua, New York native who now builds his company out of Florida, joined Jim Aroune for the latest episode of Brown and White Ventures. On the program, he goes in-depth about his company, as well as the crypto currency company, nftXc.biz, that will launch a new crypto currency specifically for digital collectibles. Find the program at Brown and White Ventures website and at this link: https://youtu.be/coTgcazdM6U

JULY 21, 2025

Paradigm's Innovation: Clean Running Diesel Engines "For Those Who Can't Afford To Wait"

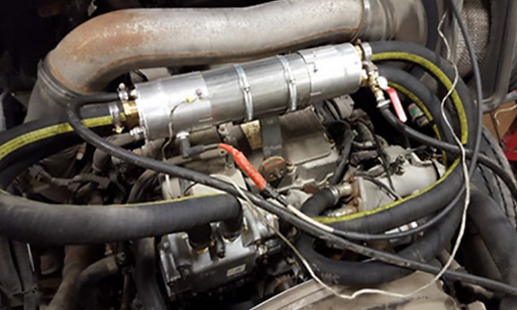

Paradigm plasma system installed on diesel engine

Paradigm Emissions Technologies, a new portfolio company of Brown and White Ventures, has developed its plasma system to address pollutants produced by diesel engines without requiring filters or chemicals. Its device creates a low-maintenance alternative to traditional filtration systems that is compatible with both exhaust gas recirculation (EGR) and downstream after-treatment configurations. It cost-effectively removes PM from exhaust gas recirculation (EGR) and exhaust Aftertreatment including diesel particulate filters (DPF). Elimination of the most lethal fine particles is especially important. “This support (from Brown and White Ventures) will accelerate our ability to scale, deepen our pilot programs, and bring our technology to more fleets and OEMs that can’t afford to wait for other powertrain technologies to become viable,” said John Erbland, Paradigm founder and CEO. The Paradigm system is a relatively compact device which can be easily installed in the engine’s EGR System or downstream with other aftertreatment devices. It is a pass-thru device with no back-pressure fuel penalty and it does not require heat to operate. The system connects to the engine’s electrical supply. Paradigm’s “Smart Pipe” controller constantly communicates with the engine ECM. Paradigm’s Plasma Reactor System can be combined with catalyst technology to reduce PM, HC, CO and NOx. Paradigm plans to launch its second-generation product in 2026. Its pilot program is scheduled to include the fleets of: Monroe County (NY), Casella, Lewis Tree, and Regional Transit Service (RTS). The pilot would validate performance and demonstrate real-world impact.

JULY 16, 2025

.jpg)

Brown And White Ventures Investing in Paradigm Emissions Technologies

Bona's Alum Leading Clean Tech Startup Decarbonizing Diesel Engine Emissions

Brown and White Ventures has reached an agreement to invest in Paradigm Emissions Technologies, Inc., a pioneering clean-tech startup based in Rochester, NY, focused on advancing the sustainability of diesel engines through innovative emissions-reduction decarbonization technology. Founded by John H. Erbland and Neville F. Rieger, Paradigm Emissions Technologies designs and manufactures a patented decarbonization plasma technology device that significantly reduces CO₂ emissions, improves engine fuel efficiency, and lowers fleet maintenance costs. With the potential to eliminate global CO₂ at gigaton levels, Paradigm Emissions Technologies provides a pathway to net-zero emissions, while helping fleets operate cleaner, longer, and more sustainably. Paradigm Emissions Technologies is backed by third-party testing and active pilot programs across New York State with a mission to deliver real-world solutions that balance environmental impact with economic feasibility. “We are proud to be investing in the team at Paradigm and its outstanding system,” said Jim Aroune, General Partner with Brown and White Ventures, LLC. “It presents an opportunity in the emissions control sector, and the significant diesel engine base that operates in our communities and our industrial, construction and municipal sectors.” “We’re honored to have Brown and White Ventures join us as a strategic partner in this next phase of growth. Their investment is a strong vote of confidence in our technology and our mission to deliver practical, real-world solutions that reduce emissions and improve air quality today,” said Erbland, founder, and CEO of Paradigm Emissions Technologies. Paradigm Emissions Technologies has developed its system to address pollutants produced by diesel engines without requiring filters or chemicals. Its device creates a low-maintenance alternative to traditional filtration systems that is compatible with both exhaust gas recirculation (EGR) and downstream aftertreatment configurations. “Investing in Paradigm Emissions Technologies aligns with our commitment to energy and technology startups, and manufacturing in Western New York and the Rochester/Finger Lakes regions,” said Aroune. “The Paradigm system offers fleet operators a compliance-ready option without having to replace equipment or modify support systems. Our study leads us to conclude Paradigm is on the road to unlocking significant value in a sector largely overlooked.” Paradigm Emissions Technologies plans to launch its second-generation product in 2026, with pilot programs scheduled with fleets operated by: Monroe County, Casella, Lewis Tree, and Regional Transit Service (RTS) to validate performance and demonstrate real-world impact. “This support (from Brown and White Ventures) will accelerate our ability to scale, deepen our pilot programs, and bring our technology to more fleets and OEMs that can’t afford to wait for other powertrain technologies to become viable,” said Erbland. Its investment in Paradigm Emissions Technologies will also mark the first time the venture capital fund will invest in a startup founder who is an alumnus of the university. John Erbland earned a B.A. in Economics from St. Bonaventure University.

JULY 9, 2025

"Fast-paced and deeply rewarding."

Venture analyst intern shares more about his first two months with Brown and White Ventures

By Gabriel Kiekenbeck

From day one, I was welcomed into the investment team—sitting in on founder pitches, asking questions, and contributing to internal conversations about deal opportunities. What made the start of this internship particularly meaningful was being involved in the deal sourcing process from the ground up. In May, we began identifying and evaluating a diverse pipeline of early-stage startups. After narrowing the list to our top prospects, I had the chance to dig into detailed diligence—analyzing business models, financials, market positioning, and founder dynamics. Presenting my findings and helping inform the team’s investment decisions has been both challenging and energizing. Working in data rooms, engaging directly with founders, and drafting investment memos gave me a front-row seat to how decisions are made in venture capital. Asking whether a company can scale—and whether a founding team can actually pull it off—is a hard question, but one I’ve come to really enjoy wrestling with as I build my own intuition. One of the most valuable parts of the experience has been learning from the partners and board members at the firm. Seeing how experienced business professionals assess risk and long-term upside has been a crash course in how real world decisions are being made. What makes this internship especially meaningful is working alongside fellow Bona alumni who share my values and are genuinely committed to pushing the University and its students forward. As we move into the next phase of the investment cycle, I’m excited to continue contributing and taking on more strategic work across our growing portfolio. Gabriel Kiekenbeck is a recent graduate of St. Bonaventure University, where he studied Business Administration and Management.

JUNE 30, 2025

KAVHelmets announced it will serve as the official helmet sponsor for Gravel Worlds 2025, one of the most renowned grassroots gravel races in the nation. This year's Gravel Worlds takes place in Lincoln, Nebraska, August 20–24, Gravel Worlds welcomes riders of all levels—from those conquering 30 miles or exceeding 300. Organizers call it a race built on camaraderie, determination, and a shared love for gravel riding, "with no egos and no barriers, just gravel, grit, and great people." KAV's announcement comes after the successful launch of its newest racing helmet model, Rhoan. It's Rhoan helmet is 3D printed KAV says it's made to channel air and shed heat. The company's AI manufacturing process creates a purely custom-fit helmet, designed to exceed safety standards while providing riders the conditions for speed that matters in competition. Rhoan is one of two models produced by KAV manufactured in the company's new production center in Buffalo, NY. The helmet company has built a strong connection to Gravel World. The riding event launched under the banner of The Goodlife Gravel Adventure in 2008. KAV describes it as a riding event with no categories, no officials and no prize money; just pure, unscripted competition and post-ride camaraderie. Registration for Gravel Worlds 2025 is now open. KAV expects its riding community to be a part of the event, promoting this year's edition of Gravel Worlds with: "Choose your route. Gather your crew," and it's trademark slogan: "Get Out There." KAVHelmets is a portfolio company of Brown and White Ventures.

JUNE 20, 2025

Brown and White Ventures co-founder Jim Aroune has been invited to join other WNY venture eco-system contributors to judge applicants for the Year 11 Cohort of the 43 North. The eleven-year-old startup accelerator invests $1 million in five companies each year that commit to relocating to Buffalo through its immersive program. Each year, 43 North teams up with VCs, operators, and ecosystem supporters to review and score applications. Hundreds arrive. 43 North counts on judges to spot-check, validate, and ensure quality and integrity in the selection process. Judges are matched with applicants based on industry expertise and areas of interest, offering a chance to see relevant deals. Scoring is virtual. A scoring template is provided by the program. Applications for 43 North's Year 11 Cohort close July 9th. Applicants are then assigned to judges two days later. Judges offer scores for the applicants four days later.

JUNE 19, 2025

As packages began piling up on the doorsteps of America during the COVID-19 Pandemic, and porch pirates became a growing threat in its neighborhoods, the founders of Hello Package realized they could engineer a solution. Atlanta-based Package Solutions recognized security, efficiency and convenience could come together within the hallways of the nation's multi-unit housing developments and properties where single spaces filled with the needs of the isolated consumer. Hello Package has launched in apartment complexes and dormitories in the U.S. Southeast. Its CEO, Paul Favorov, told Brown and White Ventures Podcast the company is expanding West and into the Northeast. "We realized Hello Package is not just a technology company that solves package deliveries, it is a solution for drivers who need to make the delivery," Favorov said. Hello Package installs secure, accessible onsite space for convenient local package handling. It onboards and trains residents, delivery drivers and property staff, ensuring smooth operations and clear communication. Delivery alerts arrive for residents, who are led to the secure Hello Package pickup space at their property. It is there that packages, already dropped off by drivers with controlled keypad access to the space, have been stored by delivery drivers in shelving units assigned by the Hello Package system. Computer vision and tracking confirm package delivery and guide residents to the area within the space where they will find their package and, in seconds, find what they were expecting. To learn more about the company, head to HelloPackage.com Find the podcast at the fund's YouTube channel: https://www.youtube.com/watch?v=SYzzwM1DIiM

SEPTEMBER 24, 2025

America’s fourth largest industry struggles to technically catch up with the times and develop true standards for communication and accountability. Into that gap arrives wellconnected, a Buffalo, New York startup seeking to lend a hand to social services and community service providers closest to home. Duane Conners told Brown and White Ventures podcast during a conversation in Williamsville, NY that his startup’s transforming how people access services; regardless of what kind of service the person needs. Through its allco platform, wellconnected binds a region’s agencies into seamless, efficient and more productive community assets, for both those seeking social services, and also services provided by: healthcare, housing, food, education and local government. “It’s a model that allows the tech to be that cobweb sticks everyone together. And allows for a digital no-wrong-doing.” Conners, a former lead at Kaleida Health, designed allco in partnerships with hundreds of organizations to unify onboarding and share collaborative case coordination. “Any agency, any one you speak with on the platform, allows you access to all of the services you need, near or far that most effectively help you.” Conners said his eight-year-old platform helps people who help people, including those on the ground working in food pantries, homeless shelters, school districts, county governments. It allows those organizations and their members to digitally collaborate.” Chicago and Cook County, Illinois, West Virginia, parts of New Jersey and Buffalo and Western New York implement allco and see their service enhanced through allco platform. “Our industry; most of it is ad hoc. And that’s what humans are. We work with individuals and individual care plans. But all those agencies don’t have communication tools and integration that can best support success,” Conners said. Listen to the entire conversation with Duane Conners at the link: https://www.youtube.com/watch?v=fYKmPfWXMz8

SEPTEMBER 13, 2025

Shaving your head is what a cyclist who wants a custom-fit helmet would ordinarily have to do to get exactly what they want. KAV Helmets CEO Whitman Kwok muses that, when his company realized that was the cutoff point for consumers to buy into his new line of five-star safety certified custom-built lids, a better system of measurement had to be developed. “Not that many people are that committed to our product to do that,” Kwok joked with co-hosts of News4Buffalo’s morning show September 9th. KAV’s one-selfie, AI-driven custom measurement system allows consumers to send a single image of their head into the company’s app when purchasing a helmet. That snapshot, plugged into an algorithm that also measures facial features to assist in the design of the custom helmet, delivers a near-perfect fit, according to Kwok. Manufacturing breakthroughs like that helped KAV remain the only cycling helmet maker producing helmets in the United States. Leveraged with patented materials with which the helmet is made, and a 3-D printing model that drives an environmentally-friendly, efficient production model, KAV has gone from Silicon Valley startup to Western New York manufacturer. Kwok and company moved full operations from Redwood City, California to Buffalo’s Old First Ward in August. The cost of doing business in the region made more sense for KAV’s next step in its business ascent. Kwok called out the region’s workforce and the Buffalo community’s support of KAV for the decision during his conversation on News4Buffalo. “Because of the people, the dollars and cents work out,” Kwok said. “For us, our fundamental premise is we built a technology, we call it micro-fab; a mini-factory that’ s allowed us leap frog a lot of the reasons people tend to offshore.” KAV continues to leverage relationships it built as a Cohort 9 winner of the 43North startup contest in 2023. It led to investment from Brown and White Ventures in early 2025. Kwok says KAV will benefit from moving full operations from Silicon Valley to Buffalo because of the lighter cost of doing business and the workforce willing to take KAV to the next level. “Buffalo has such a great history of manufacturing. For us to take the best of the old and take new technology, I think it’s a winning combination.” See News4Buffalo’s segment on KAV with Whitman Kwok here: https://www.youtube.com/watch?v=NhFn2Uds2cg

SEPTEMBER 11, 2025

Brown and White Ventures will co-host an event designed to help founders navigate the complexities of early-stage financing. Professionals navigating these transactions daily will offer clarity on deal terms and investor expectations Tuesday September 16th from 5 p.m. to 7 pm. The Event: Early Stage Deals Demystified, will include analysis and guidance from Matt Weinbaum and David Valenti. Both attorneys are shareholders at Dentons in Pittsburgh, PA. Dentons and Finta are also co-sponsoring the event, set for Tuesday, September 16th at the UB Cultivator Center at 701 Ellicott Street in Buffalo, NY. Meg Kelly, co-founder of Finta, will lead the discussion. "This event will feature a practical discussion on what's market in convertible security and preferred stock financings," said Weinbaum. The event is free. Follow this link to register. https://luma.com/dk3dpaou

September 4, 2025

Calming people down about AI is one of the things Christopher Kanan must do these days. Especially when it comes to what he describes as "Terminator" stuff; where artificial intelligence overwhelms humankind. "I have a lot of arguments for that," said Kanan, an associate professor of computer science at the University of Rochester who leads the Hajim School of Engineering and Applied Sciences' AI Initiative. "I’m like 'well at least you know and you won’t be caught completely unaware.'" Kanan is the guest on the latest episode of Brown and White Ventures podcast. He frequently speaks to companies and business leaders about AI's arrival and shares why there's a first impression it makes, on boat corporate leaders and the workforce. "Companies want to embrace it as much as they can. AI does not complain. It can work 24 hours a day. It has access to a lot of information. It doesn't necessarily have to do on-the-job training, or it’s not going to need breaks. It’s not going to file a complaint or lawsuit against you," said Kanan, who holds appointments in Brain and Cognitive Sciences, The Goergen Institute for Data Science and AI (GIDS-AI) and The Center for Visual Science. Kanan believes the individual can respond to AI's arrival best by becoming a proficient applier of the technology. "Keep in mind, AI does not think when you don't engage it. When it is at rest, it's not thinking. When you're at rest, you're always thinking," Kanan said. "But if you're not using this stuff, you're going to be replaced by someone who is. So, learn how to use it." Kanan calls AI's existence in day-to-day life now its, where one study found the amount of time to complete a human task is cut in half every eight months, its "Co-Pilot" era. "It keeps getting better, and better and better at doing things, but we have to check it. Now that may sound depressing to some, but on the other hand, if everything is automated, then there's the hypothetical scenario that we get to a utopia where people only do the work they want to do, and everybody derives benefits from it."

August 25, 2025

A Silicon Valley startup choosing Western New York as its next-gen launch site had a great ring to it two years ago. But KAV Helmets, the Redwood City, California-born innovator of cycling helmets through 3D printing and AI manufacturing, has now doubled down on Buffalo. Founder Whitman Kwok announced at a grand opening event at KAV's Louisiana Street production center Thursday that the maker of custom-fit cycling helmets will call Buffalo its full-time home for all manufacturing; leaving The Valley behind for another Valley; that of the Queen City's Old First Ward. "It's not just the talent that we find here, it's the people who've been supportive, and a community that has helped us take the next step," Kwok said to a gathering of state, local and regional leaders. "This is the definition of true success for a community," said Colleen Heidinger, President of 43North, the state accelerator program that awarded KAV one million dollar as part of its annual startup competition in 2024. "We invested in KAV, wrapped our services and support around Whitman and his team. But then, the community stood up around him." Heidinger specifically mentioned the investment by Brown and White Ventures, the year-old venture capital fund built by alumni and supporters of St. Bonaventure University which operates independently of the university. "When Brown and White invested, that was a sign of this community's commitment to KAV and in 43 North," Heidinger said. KAV became Brown and White Ventures' first portfolio company in Q1 2025. The fund followed a $200,000 initial investment with a follow-on investment of $100.000 in Q2. "Innovation in manufacturing, in the region in which our fund seeks to invest, is one of the reasons we continue to support Whitman and the KAV team," said Jim Aroune, co-founder of Brown and White Ventures. "I was struck by your passion, for pursuing health, safety, and new technology, and in this place, with such an industrial past, that makes such a connection to what makes Buffalo. You are, truly, a perfect fit," Bonnie Lockwood, Regional Director of WNY, said to Kwok and KAV staff. Lockwood spoke at the factory opening event on behalf of New York Governor Kathy Hochul. KAV's Buffalo plant has operated the last two months with a staff of five. It has produced KAV's two helmet models, including its Rhoan helmet, the company's newest model. Kwok said Wednesday the company would hire three, and up to ten employees in its new micro-factory, which has dozens of nearly-silent 3D printers spinning the company's helmets. "We are extremely excited to grow with this community," Kwok said.

AUGUST 7, 2025

Brown and White Ventures Invests In HelloPackage

Fund Backs Tech-Driven Package Management Solution

Brown and White Ventures has reached an agreement to invest in Package Solutions, a startup whose lead service, HelloPackage, redefines last-mile logistics in multi-family and student housing through AI, automation, and on-site holding of deliverable packages. In HelloPackage, PackageSolutions has built a system which centralizes delivery management, package tracking, and resident communication into one intelligent system. HelloPackage, founded in Atlanta, Georgia, manages thousands of packages and delivery drivers each month—reducing operational costs, improving resident experience, and creating new NOI for property owners. “What Brown and White Ventures finds in HelloPackage is a company that enhances security and convenience in a universal experience: the home delivery of goods and services,” Jim Aroune, co-founder and General Partner of Brown and White Ventures, LLC. “PackageSolutions is poised to successfully leverage technology to address this challenge, especially for those who live in multi-unit housing and residential developments.” "We’re excited to have Brown & White Ventures join us as a strategic partner and advisor in our next phase of growth. Their investment reflects confidence in our technology, team, and vision to deliver AI, computer vision, and service that simplify last-mile logistics and elevate the resident experience,” said Paul Favorov, CEO/CTO of PackageSolutions, maker of HelloPackage. Owners and operators use HelloPackage to reduce onsite staff burden, lower costs, and improve resident satisfaction—helping communities lease faster and retain residents longer. HelloPackage currently serves 52,000 units, including communities managed by NMHC Top 20 Owners and Operators. The company processes more than six million packages annually and maintains a 4.4-star resident satisfaction rating across more than 50,000 reviews. “With the support from Brown & White Ventures, we’ll accelerate customer implementations, expand into key markets like Texas and the West Coast, and bring our AI-driven logistics solution to more communities overwhelmed by packages and delivery drivers,” Favorov said. Its commitment to PackageSolutions is Brown and White Ventures’ fifth investment in a portfolio company in its first year of distributing funding to startup companies. Learn more about HelloPackage at: https://www.hellopackage.com

AUGUST 1, 2025

Paradigm Green Emissions System Featured

Paradigm Emission Technologies CEO John Erbland with News10NBC Investigative Reporter Jennifer Lewke

The difference Paradigm Emissions Technologies makes in a diesel engine is easy to see in a pair of circular filter devices the size of a plum. One is a blackened, soot-filled ring at the end of an exhaust system that is not managed by Paradigm's plasma technology that eliminates particulates. The black is the soot normally released from diesel engines; what most of us see at construction sites, from long-haul trucking vehicles and from public and commercial bus lines. The other filter is pure white. Untouched by particulates that had been managed earlier in Paradigm's anti-particulate filtering appliance. There's no soot in this filter because the plasma system's already broken it down. The only thing pushed through the white filter is water vapor. Reporter Jennifer Lewke showed the difference during her News10 NBC Rochester report Friday, July 25, 2025 in an in-depth report on Paradigm. See more on the story at this link. https://www.whec.com/top-news/local-companys-patented-technology-reduces-diesel-engine-emissions-gains-investor-attention/ And learn more about Paradigm, a Brown and White Ventures portfolio company, at https://paradigmemissionstech.com

JULY 26, 2025

Healthcare Finance and Innovation Leader Guides wellconnected

WNY Native Bringing Social Care Together

The inspiration for the startup seeking to change social services through unifying technology and process comes from Duane Conners's extensive experience in Western New York's health and social care systems. Conners, the co-founder and CEO of wellconnected, has positioned himself as a key player in the fields of healthcare finance and innovation for a generation. Conners, a 2000 Pioneer Central graduate, studied at the University at Buffalo School of Management and graduated with a B.S. in Financial Analysis. Kaleida Health brough Conners on in 2008. His career with the region's largest health organization led to his tenure as a Senior Decision Support Advisor at Buffalo General Medical Center. Here, he provided invaluable financial and clinical analysis, aiding project and management teams in navigating complex decisions. Conners's expertise grew as he transitioned to the role of Manager of Budget and Financial Analysis at Kaleida Health, where he led a team dedicated to developing a service line-based budget across the organization. His analytical skills and leadership paved the way for future opportunities. In 2015, he briefly served as a Financial Analyst at North American Breweries, Inc. before taking on the challenge of Network Finance Manager at HealthNow New York Inc., where he played a pivotal role until May 2016. His tenure showcased his ability to blend financial acumen with strategic insights, strengthening healthcare finances. In addition to his extensive healthcare experience, Conners founded rprt in October 2015, serving as CEO until August 2022. Under his leadership, rprt specialized in creating reporting environments and implementing solid data practices that benefited nonprofit and non-tertiary care providers. This entrepreneurial venture solidified his status as an innovator in the field. Conners’s commitment to enhancing healthcare solutions can be found in his work with VBP Forward from September 2018 to April 2021, where he helped healthcare organizations develop value-based care solutions and improve population health outcomes. His collaborative spirit led to co-founding the Center of Excellence for Infection Prevention and Control (COEIPAC) in January 2017, dedicated to spearheading innovative strategies in infection prevention. His early career included significant roles at organizations like Infonaut, where he served as Vice President of Business Development, and the Western New York Impact Investment Fund as an Investment Associate. These experiences equipped him with a broader understanding of healthcare investment and operational strategies. It led to wellconnected, the newest portfolio company of Brown and White Ventures. Founded four years ago, the company's platform "allco" works directly with community-based organizaqtions to create a secure, central data hub that removes silos, allows collaboration and ultimately provides better social care services. Conners' s SaaS introduced itself in Buffalo and Erie County before making inroads into West Virginia and New Jersey. It's big break came months ago, when it engaged in a five-year agreement with Chicago and Cook County, Illinois. Conners continues to be a driving force for positive change in the industry, proving that a dedication to data-driven practices and innovative solutions can lead to significant advancements in health care delivery.

JULY 18, 2025

.jpg)

BWV Investing In Buffalo Company Revolutionizing Social Care

By Jim Aroune and Dan Miner

Brown and White Ventures announced Monday July 14, 2025 it will invest $200,000 in wellconnected, a four-year old Buffalo, New York based startup whose “allco” platform gives social care agencies a standardized way to perform intake, case management, data collection and referrals. Many different nonprofits align into one standardized system under wellconnected platform, ‘allco.' It turns inefficient ad hoc networks into engines of true collaboration. The investment by Brown and White Ventures is seed funding for wellconnected which will support the national rollout of “allco.” The platform has made major integrations with social care systems in New York, New Jersey, West Virginia and Illinois and positioned “allco” as a disruptive force dedicated to improving U.S. social care. “We find it compelling how welllconnected and “allco” tackle the long-standing fragmentation of social services in our country. We’re proud to be investing in a company positioned to become the digital infrastructure for social care in the United States,” said Jim Aroune, General Partner at Brown and White Ventures. “We’re grateful to the team at Brown and White Ventures for understanding the scope of vision as we pursue this very important mission,” wellconnected founder and CEO Duane Conners said. “wellconnected is bringing deeply necessary change that brings structured data and real-time analytics to the American social safety net so that we can provide quality resources and service to community members who need it most.” Conners reports “allco’s” primary clients include: non-profit organizations, public sector agencies and health insurers. The platform can also serve municipal governments engaged in delivering social care services, including housing support, food assistance, re-entry programming for formerly incarcerated individuals, mental health counseling and employment services. "By backing wellconnected, Brown and White Ventures sees an opportunity to make good on our Franciscan mission to promote compassionate service, respect and peace in our investments," Aroune said. In 2021, Conners and Jamie Bono founded "allco." One of the platform's first partners was 211 Western New York, which received funding from Launch NY and Buffalo Innovative Seed Company. While wellconnected would land contracts in New Jersey and West Virginia, it was the closing of a five-year pilot program contract with the city of Chicago and Cook County, Illinois that doubled the company's revenue in 2024.

JULY 14, 2025

In Search Of Best Way To Make Helmets, Bike Podcast Turns To KAV

by Brown and White Ventures

For all the pedaling and pounding pace cyclists endure, bike helmet safety and speed can come down to the polymors under the shell, especially the proprietary kind KAV Helmets put to use. KAV founder Whitman Kwok shared that and more about his helmet company on the N-1 Podcast with James Huang. Huang, who promotes his program to be all the bicycle news that's fit to print, toured KAV's California headquarters to learn more about the startup and how it's challenging the manufacturing process of cycling safety. N-1's title for the episode: Turning The Bike Helmet Hegemony On Its Head. KAV Helmets is a portfolio company of Brown and White Ventures.

JULY 9, 2025

Halfway through my internship and I’ve already learned more than I ever imagined. In my first week at Brown and White Ventures, I had the chance to learn about the company’s mission, values and investment approach. I was also welcomed by an incredible team that has supported and guided me throughout the journey. One of the most valuable parts of this experience has been participating in founders’ pitch meetings, where I learned how to actively listen, identify key focus areas and ask thoughtful follow-up questions. From these sessions, I helped prepare investment memos for companies selected for investment consideration. Research we produced and presentation we delivered in these documents played a key role in pushing a deal into follow-on discussions. Through the investment memo process, I learned how to conduct detailed due diligence, financial modelling, market research, assess risks and evaluate product-market fit working with real data and develop comparables to support recommendations. Headline: Brown and White Ventures invites its interns to participate in follow-on meetings with selected startups. We observed how experienced investors think critically and ask sharp, concise follow-on questions of a prospective investment's financials, business models, risks, defensibility, and team dynamics. In one of these conversations, we learned to assess whether assumptions in revenue forecasts were realistic based on historical data and market benchmarks. These meetings helped me move from theoretical knowledge to practical insight, where I could anticipate what questions matter most to investors and why. Beyond analysis, fund staff shared how to pitch and confidently present what we do as a fund, and how we invest. Taking part in the pitching process boosted my confidence and sharpened my communication skills. I’m grateful for the experience so far and look forward to continuing learning in the second half of my internship. Sandisiwe Nyama is a recent MBA graduate of the Kogod School of Business at American University. She earned her undergraduate degree in Banking and Finance from Great Zimbabwe University.

JUNE 25, 2025

Brown and White Ventures announced that Neil Bommele of Fairport will serve as the fund's newest Associate. Bommele has applied his experience as a member of the venture capital fund's board since 2024. A proud alumnus of St. Bonaventure University (Class of 1987,) Bommele is renowned for his enthusiastic engagement with his alma mater. Neil is a firm believer in the strength of alumni networks to generate business opportunities and support the institution’s growth. Bommele's diverse career in sales across sectors such as mortgages, consumer goods, and real estate management highlights his adaptability and entrepreneurial drive. He owned Healthy Vends, a food vending company. Bommele also previously worked at Oxford Mortgage, Recorded Books and Wilton Enterprises. Bommele's dedication to strengthening alumni connections continues to benefit the fund and the university at large.

JUNE 20, 2025

Insights

Brown and White Venture Podcast Episode 101, premiers April 29, 2025.Host Jim Aroune welcomes David Brown, managing partner at Impellant Ventures and Board Chair at Upstate Capital Association of New York to discuss upstate's venture capital ecosystem, the need for mentors in vc and the "one thing" VC across upstate needs more "collisions."

JUNE 5, 2025

New KAV Helmets Model Rolls Out Of WNY Plant

Tour Of New Buffalo Production Center

KAV Helmets, makers of a revolutionary cycling helmet that is made using AI and 3-D printing, brought its manufacturing center in Buffalo, NY to life in May 2025. KAV staff share more about the launch of production in Western New York, as the 43 North alum and California-born startup hits a new gear.

JUNE 5, 2025

Lawyers Launching Their Own Firms

Von Wooding, Counsel Stack

New Legal Tech leads with AI Research, crosses with what its founder calls a platform that's "a law firm in a box."

Counsel Stack, a legal teach startup leveraging AI for research and law firm operations to enhance attorney efficiency, can also create opportunity for lawyers who wish to launch their own firm; as explained by Counsel Stack founder Von Wooding. Recorded March, 2025 in Pittsburgh, PA.

JUNE 5, 2025

Introducing Legal AI When Trust Is At A Premium

Counsel Stack founder Von Wooding told the Pittsburgh Post GAzette about the challenges of AI in law and the courts, and how his company's platform responds to those challenges. Comments shared in an interview in January 2025.

JUNE 5, 2025

KAV's Custom Fit FInds Talent Fit In Buffalo

Whitman Kwok, founder and CEO of KAV, speaks on the workforce of the region as he prepares to open his cycling helmet company's new manufacturing center in Buffalo, NY. January 2025.

JUNE 5, 2025

Old Factory Becomes KAV Helmets New Manufacturing Center

Brown and White Ventures gets its first look at KAV Helmets new cycling helmet production plant. The Silicon Valley transplant is opening a plant on Louisiana Street in the Old First Ward of Buffalo, NY. KAV's Alex Greening and Megan Kelly lead us in January, 2025 through the company's corner of what was, in the 20th century, a BarcaLounger chair factory.

JUNE 5, 2025

Range of Investment at BWV

Brown and White Ventures founder Chuck O'Neill explains the investment range for the venture capital fund to Buffalo Business First reporter Lian Bunny, December 2023. Brown and White Ventures was first named the St. Bona Venture Fund I. It changed that name to Brown and White Ventures in 2024.

JUNE 5, 2025

COUNSEL STACK MAKES ITS CASE

Brown and White Ventures Podcast: Counsel Stack Founder Von Wooding

Host: Jim Aroune

Host Jim Aroune welcomes Von Wooding, founder of Counsel Stack, legal tech startup focused on delivering a reliable AI suite of services for attorneys, law firms, courts and law students. Wooding, a graduate of the Thomas R. Kline School of Law at Duquesne University and, before that, Oberlin College football player, shares how he developed Counsel Stack as a way to pass the Bar Exam, how it stacks up to the exacting expectations of the legal industry, and why it could set free a new generation of law practitioners.

JUNE 5, 2025

Creative Collisions and Why Upstate's NY's Venture Scene Needs More

Dave Brown, Impellant Ventures

Brown and White Podcast

Host Jim Aroune welcomes David Brown, managing partner at Impellent Ventures and Board Chair at Upstate Capital Association of New York to discuss upstate's venture capital ecosystem, the need for mentors in vc and the "one thing" VC across upstate needs more are "creative collisions."

Full Episode: https://youtu.be/v3uJeC7lEk4

JUNE 5, 2025

KAV Factory Takes Helmet Maker To Next Stage

WKBW-TV Anchor Michael Wooten profiles KAV and Brown and White Helmets as KAV prepares to open its Buffalo, NY manufacturing center. With KAV Founder, CEO Whitman Kwok and Brown and White Ventures General Partner Jim Aroune.

JUNE 5, 2025

How Can AI Work For A Law Firm and Those It Serves

Counsel Stack, a legal tech platform that applies AI for research and law office operations, is demonstrated by founder Von Wooding and attorney James Cartwright. Produced in Pittsburgh, PA in March 2025.

JUNE 5, 2025

Why Launch A Startup: KAV Founder, With A Word For Entrepreneurs

KAV founder Whitman Kwok speaks to entrepreneurs and why they should "do it." KAV is a company supported by investment by Brown and White Ventures. Feb. 2025

JUNE 5, 2025

First Impression: Brown and White Ventures Introduced at SBU

Chuck O'Neill, St. Bonaventure University Class of 1983, and founder of venture capital fund Brown and White Ventures, speaks to university alums and local business leaders about the launch of the fund in December, 2023. O'Neill speaks at the Swan Center at SBU.

JUNE 5, 2025

A Safer Ride: KAV Helmets Original Mission

KAV Helmets founder Whitman Kwok describes how his company's cycling helmets, engineered to be three times safer than others, meet the protective needs of those who wear them.

JUNE 5, 2025

.jpg)